Investment attorneys for social impact startups and community-minded companies

We help new and growing businesses get set up to raise capital online and through their private networks using innovative strategies and design thinking you won't find anywhere else.

Building your big, bold dream requires cutting edge legal services—which often, goes hand-in-hand with an infusion of capital.

We are experts in the regulations, new and old, that support investment in small business (we actually get really excited about this). We also believe law should be a tool and not a hammer, and we use it as part of a multidisciplinary lens to help custom-tailor capital raises for companies just like yours. With roots in both community development and startup consulting, we are fully dialed in to the specific needs and realities you deal with every day. Rest assured your long-term strategy, legal documents, and compliance plan will all be ultimately aligned.

Special Sauce

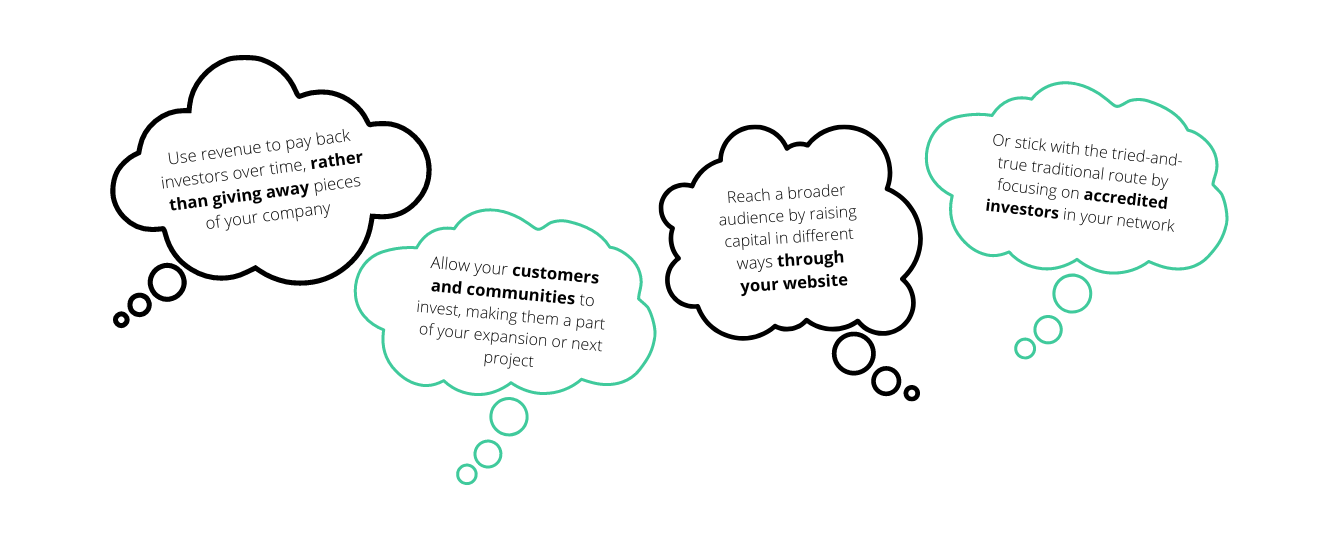

Revenue-based Finance

Revenue-based finance (or revenue-based investing, as it’s also called) allows you to allocate a healthy portion of your future revenues to keep investors happy, rather than being bogged down by more extractive or power-disparate arrangements. It prevents you from paying out anything you can’t afford, and it gives you your company back in the end. It’s essentially a class of investing, with a lot of customizable features, and we think it’s the right answer for a lot of early stage or local businesses. It also just happens to be our specialty.

Community Finance

This type of investment round can be structured a variety of ways, but the common thread is that you’ll be able to publicly promote the offering to potential investors (think TV spots, email newsletters, social media), and you’ll be able to take investment online. Depending on your needs and networks, you can open up the offering to your community of customers, fans, supporters, and allies, or you can keep it limited to higher net worth folks in your circles. You can focus on local investors in-state. Or you can seek to reach a broader regional or national community. The options are many. But any way you slice it, it unleashes a boatload of new possibility for early stage entrepreneurs.

Private Offerings

In a private offering, you’ll be limited, in many cases, to what’s called accredited investors. This is how many traditional companies have raised their first round of investment. You’ll need to have connections to wealthy individuals or organizations that might want to invest in your offering, but if you do, it’s a great (and very common) option.

Successfully serving CPG/food/beverage companies, coffee shops, breweries, real estate funds, service professions, healthcare, and tech for over a decade.

From New York to Los Angeles to Atlanta to Miami—and everywhere in between.

Strategy — Execution — Regulatory Compliance — End-to-end Support